Reflecting on President Trump’s first 100 days in office

Search

Search

Search

Search

Banks relying on back-leveraged SRT trades in the UK now face increased regulatory scrutiny. The PRA's "Dear CFO" letter warns that not all repo financings collateralised by SRT tranches meet the trading book’s liquidity standards. While positioned as targeting a narrow subset of illiquid transactions, this letter has potential implications on a wider range of SRT financing transactions. Financial institutions may now find that the regulatory capital treatment of repo financing could, for certain transactions, be higher than initially envisaged. With Basel 3.1 reforms in the UK also tightening eligibility standards, banks may need to move quickly to reassess their policies, renegotiate legal barriers to liquidation, and demonstrate genuine secondary market depth – or risk a material shift in the economics of SRT financing structures.

On 9 April 2025, the Prudential Regulation Authority ("PRA") issued a "Dear CFO" letter (the "Letter") outlining its prudential expectations regarding practices related to illiquid and structured financing portfolios, focussing in particular on the significant risk transfer ("SRT") transactions, although noting that it expects firms to consider the application of the feedback to all relevant financing portfolios. The PRA noted that not all banks were demonstrating a sufficiently thorough assessment of collateral eligibility for the purposes of capitalisation of securities financing transactions ("SFTs") such as repos under the trading book rules. It urged banks to ensure that their internal policies for allocating regulatory capital appropriately reflects the substance of the transactions (including, in particular, the liquidity of the underlying collateral being used in SFTs).

The PRA made clear that the Letter related to a "subset" of less liquid financing activities, and did not comment on the wider SRT market nor the use of back leverage and/or repo financing of SRT positions more generally. In particular, it did not go as far as the International Monetary Fund in its Global Financial Stability Report 2024, which suggested a wider interconnectedness and a negative feedback loop concern (i.e. the concern that the credit risk which banks transfer under SRT transactions remains in the banking system as a result of back leverage). The Letter makes clear that the PRA does not view the financing of an SRT position the same as owning that SRT position outright.

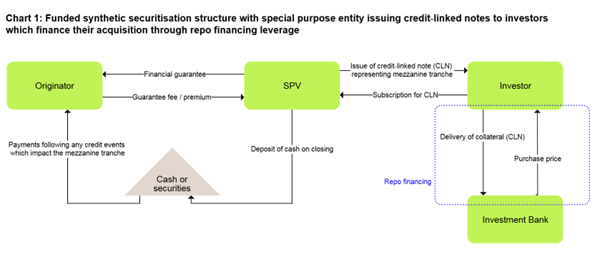

The use of leverage by protection sellers to finance participation in SRT tranches has become increasingly common. This approach is particularly attractive for specialist credit funds, which frequently seek financing solutions from investment banks. In such structures, the funded SRT position is often used as collateral for a repo transaction with the financing bank, enabling the investor to monetise the position while retaining economic exposure. The below diagram sets out an example of how repo financing can be used in the SRT market:

Under this structure, the investor funds the acquisition of the CLN through the back leverage provider, typically the investment bank, by entering into a repurchase transaction. The investor sells the CLN to the investment bank pursuant to the repo agreement, with an obligation to repurchase it at a pre-agreed date (such as the maturity or repayment date of the CLN) and at a pre-agreed price. Coupon payments received on the CLN are passed through to the investment bank as part of the repo’s price differential, and may be subject to a negotiated sharing arrangement between the investor and the investment bank. The delivery of the funded CLN under the repo is generally subject to a haircut to reflect collateral volatility and credit risk considerations.

The PRA considers that the use of illiquid assets, such as funded SRT tranches, as collateral in repo transactions poses a prudential risk where such assets are recognised as liquid for trading book purposes. In cases where the secondary market for the collateral is limited or lacks sufficient depth, the PRA expects that the associated repo exposure should be classified in the banking book. This approach is intended to prevent the inappropriate application of market risk capital frameworks to fundamentally illiquid exposures, thereby mitigating the risk of undercapitalisation.

Although there are a number of instruments which under the CRR are required to be included in the banking book (for example, instruments designated for securitisation warehousing and unlisted equities), repos and other forms of securities financing are generally eligible to be included in the trading book, depending on the bank's trading intent and policies. The key distinction is that if the repo was booked in the banking book, the bank would only be entitled to recognise the SRT instrument as collateral for credit risk mitigation purposes if it complied with the fairly prescriptive eligibility criteria under Article 197, which broadly only permit highly rated or 0% risk-weighted exposures, or securitisation positions with a risk weighting of less than 100%. In a banking book context, the repo would typically be classified as an unsecured exposure to the investor, given the likely ineligibility of the SRT instrument as eligible collateral. By contrast, within the trading book, institutions are permitted to recognise as eligible collateral "all financial instruments and commodities that are eligible to be included in the trading book." Accordingly, where the financing bank can demonstrate that the SRT instrument satisfies the trading book eligibility requirements, it may rely on the collateral to reduce the counterparty credit risk exposure associated with the repo transaction. One of the key eligibility criteria will be the liquidity of the collateral (including legal and operational risks associated with an orderly liquidation and/or transfer of such collateral).

The PRA’s primary concern, as articulated in the Letter, centres on whether institutions, such as the investment bank in the example above, can substantiate that SRT instrument collateral satisfies the liquidity and tradability requirements necessary for trading book recognition. Specifically, institutions must demonstrate the existence of an active, liquid two-way market, or, where appropriate, rely on robust internal modelling frameworks. In the absence of such evidence, the repo transaction would be treated as an unsecured exposure and/or reclassified into the banking book, where the institution would be unlikely to benefit from any credit risk mitigation recognition.

To date, similar concerns have not been publicly raised by EU regulators or the ECB. This may reflect differences in regulatory approach or supervisory focus and the treatment of repo financing of structured credit collateral may become a more acute supervisory issue for UK-regulated institutions relative to their EU counterparts.

The PRA's Letter highlights a subtle but important regulatory pressure point: the use of illiquid collateral in repo financing structures. Although the PRA has not messaged that back leverage and/or the financing of SRT positions by banks will be frowned upon, and has confirmed that the Letter focuses on a subset of the least liquid financing transactions, the implications of the Letter and the subsequent review could have wider implications on the SRT market.

Institutions will need to assess critically whether adequate safeguards exist or need to be put in place to continue recognising such exposures as eligible collateral for trading book purposes. Potential mitigants could include the application of deeper haircuts under repo transactions to address the volatility-adjusted value of the SRT instrument, as well as enhanced due diligence at the inception of the repo to ensure that there are no legal or operational barriers to liquidation in the event of counterparty default. As highlighted above, this may necessitate early engagement with originating bank to address restrictions on transferability or confidentiality obligations that could otherwise impede an orderly exit.

Finance providers may need to update their policies to take into account the new draft instrument, and to be able to demonstrate either a publicly active market or an internal model capable of assessing all the relevant risks. Failure to do so could have an adverse impact on the bank's regulatory capital treatment for such repo transactions. It remains to be seen whether this dampens investor appetite in an SRT market which regulators and market participants have to date championed as an important bank capital management tool.

The PRA has urged firms to consider the concerns highlighted in the Letter and, where necessary, ensure that associated policies, control frameworks and reporting are enhanced to address any potential issues. Supervisors will be in contact with relevant firms, with such firms being required to produce a written response by 11 June 2025. Subject to the responses, the PRA may consider whether further engagement is required.

This note is for guidance only and should not be relied on as legal advice in relation to a particular transaction or situation. Please contact your normal contact at Hogan Lovells or any of the authors if you require assistance or advice in connection with any of the above, including in respect of any significant risk transfer securitisation and/or any regulatory capital queries.

Authored by James Doyle and George Kiladze.